EquityZen Celebrates 10 Years of Multi-Company Funds

Through these funds, investors can access a group of private companies aspiring to transform our world

Ten Years of EquityZen Multi-Company Funds

EquityZen Multi-Company Funds

Diversified exposure in the private companies aspiring to transform our world

Draft Kings, Instacart, Mongo DB, Palantir, Robinhood, Spotify, The Honest Company.1

Why invest in pre-IPO companies?

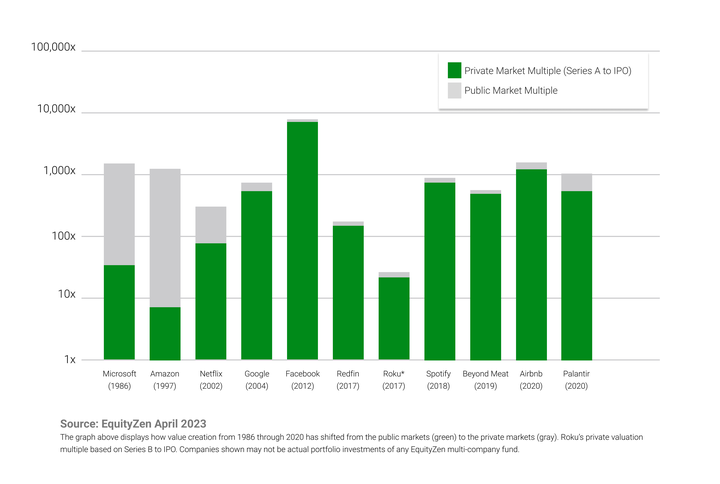

As private companies are staying private longer, value creation is increasingly occurring before companies go public. In 2004, companies typically went public after 4 years, today the average company IPOs after 10+ years.2

Until recently, access to investment opportunities in pre-IPO companies has been limited. Over the last ten years, EquityZen has enabled accredited investors to add late-stage, private technology innovators to their portfolios.

The EquityZen difference

Across all offerings, EquityZen has completed over 41,000 transactions in more than 450 companies.

Our experienced investment committees follow each fund's distinct strategy to select a targeted subset of opportunities on our marketplace.3

Efficient deal execution driven by EquityZen's proprietary technology enables investors to invest at low investment minimums.

“I've been wanting to invest in [this company] for years and never found the tiniest crack in the door. You made it happen.”

- Prior EquityZen Fund Investor

“A game-changer for folks like me to get in [on] private equity ownership."

- Investor, California

"You are THE best platform that I have used. It is not a compliment, it is a fact."

- Investor, California

The testimonials presented above have been provided by investors in EquityZen funds. The testimonials were unsolicited and the investors who provided them were not compensated. These testimonials may not be representative of other investor’s experiences and they do not guarantee the future performance or success of any EquityZen fund investment. Please refer to our Disclosures page for a discussion of conflicts of interest that arise from these testimonials.

1 Past performance is not indicative of future returns. Not all pre-IPO companies will go public or get acquired, and not all IPOs or acquisitions will result in successful investments. Not an exhaustive list of previous portfolio companies. There are inherent risks in pre-IPO investments, including the risk of loss of the entire investment, illiquidity, and fluctuations in value and returns. Nothing set forth here shall constitute an offer to sell any securities or a solicitation of an offer to purchase securities in any jurisdiction. Any offer to sell or solicitation of an offer to purchase shall be made only to qualified investors through a private placement memorandum and associated offering documents (“Offering Documents”). The specific terms of an investment are subject to the Offering Documents, which will contain additional information not set forth here, including a description of certain risks of investing, which will be material to any qualified investors decision to invest. Securities offered through EquityZen Securities LLC, member FINRA/SIPC. Not an exhaustive list of previous portfolio companies.

3 The past performance of the multi-company fund's managers, its principals, members, or employees and any other fund or investment vehicle sponsored by the multi-company fund manager or its affiliates is not indicative of the future returns. There is no guarantee that the multi-company fund will be successful in achieving its investment objectives.

Investment opportunities posted on this website are "private placements" of securities that are not publicly traded, are subject to holding period requirements, and are intended for investors who do not need a liquid investment. Investing in private companies may be considered highly speculative and involves a high degree of risk, including the risk of substantial loss of investment. Investors must be able to afford the loss of their entire investment. See our Risk Factors for a more detailed explanation of the risks involved by investing through EquityZen’s platform.

EquityZen Securities LLC (“EquityZen Securities”) is a subsidiary of EquityZen Inc. EquityZen Securities is a broker/dealer registered with the Securities Exchange Commission and is a FINRA/SIPC member firm.

Equity securities are offered through EquityZen Securities. Check the background of this firm on FINRA’s BrokerCheck.

EquityZen.com is a website operated by EquityZen Inc. ("EquityZen"). By accessing this site and any pages thereof, you agree to be bound by our Terms of Use.

EquityZen and logo are trademarks of EquityZen Inc. Other trademarks are property of their respective owners.

© 2024 EquityZen Inc. All rights reserved.